Connect

Move

Boost

Protect

Use Cases

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Ecommerce

Retail, fashion, consumer goods, and digital services

Crypto

Exchanges and wallet

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.

TRAVEL PAYMENTS. WITHOUT THE TURBULENCE.

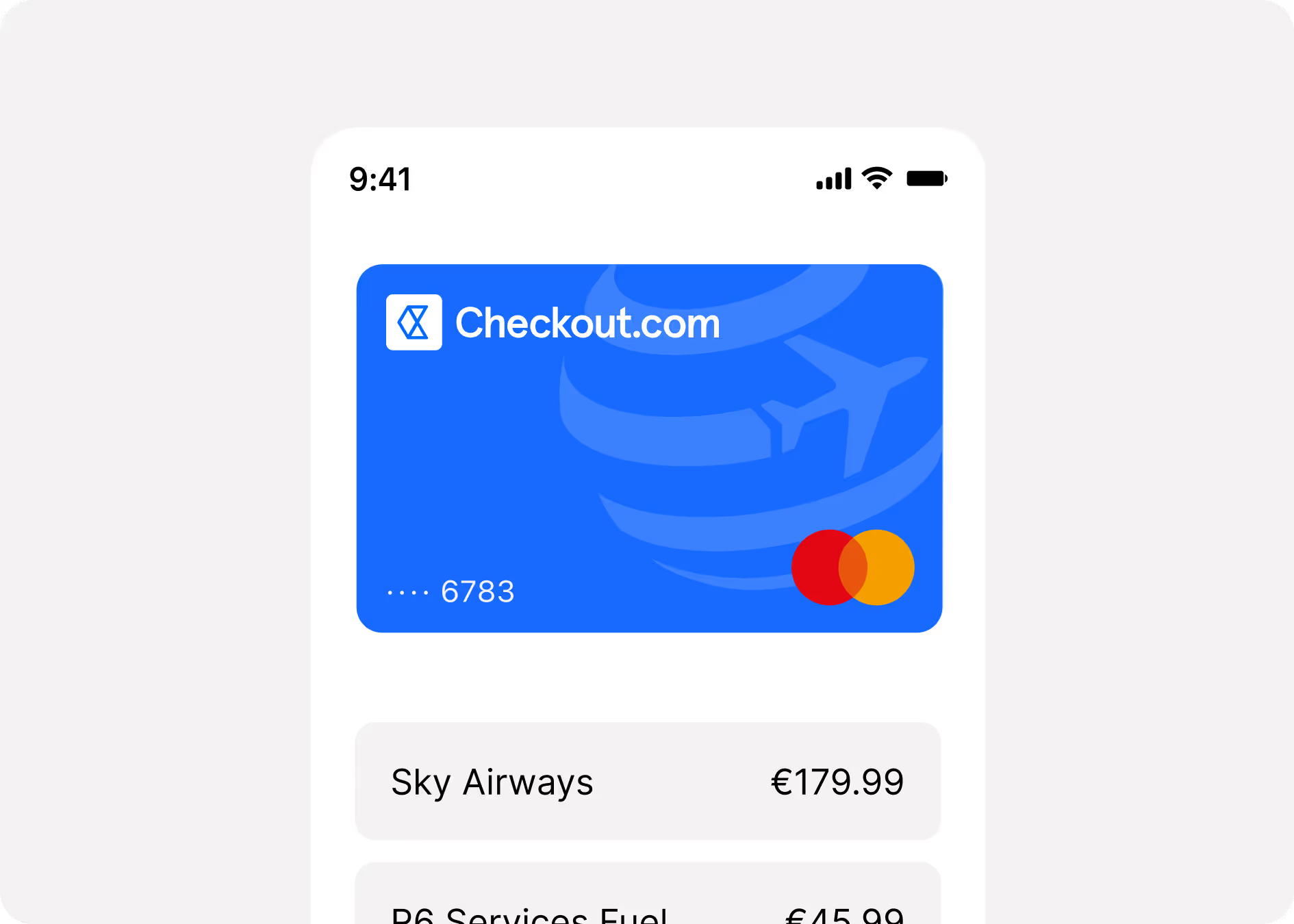

By combining acquiring and issuing, Checkout.com helps online travel agencies (OTAs) to smooth out the journey from receiving customer payments to paying suppliers.

The industry never stands still

In online travel, staying ahead demands adaptability. Competition is tough, margins are thin, and managing transactions across a global ecosystem is complex. Timely payments, robust security, and guarding against financial risk are essential for successful partnerships. And customers expect high-quality experiences. That’s where Checkout.com comes in.

Fly non-stop from ‘payment received’ to ‘supplier paid’

Use your sales balance to fund virtual cards – issued the moment a customer payment is taken – then pay all your suppliers. Transform a cost center into a revenue generator by earning interchange revenue when paying your suppliers. Manage the whole payment journey on one platform (with one point of contact for support), reducing your exposure to fraud and errors.

-

item1

-

item2

“We’re delighted to partner with Mastercard to complement our virtual card issuing solution with Mastercard’s Wholesale Travel Program, enabling OTAs to unlock new revenue streams and deliver a connected customer experience.” Meron Colbeci Chief Product Officer at Checkout.com.

Boost your revenue

Every transaction counts. As your issuer, we build the optimal payment flows to boost your acceptance rates without compromising security. Combined with the preferential interchange revenue you’ll earn from payouts, your bottom line stands to benefit.

Defend against FX risk

Stop paying more than your quoted prices due to unfavorable FX rate changes. With Checkout Issuing, you can spin up a virtual card in a local currency, removing the risk of unfavorable conversion rates when the payment is made to your international suppliers.

Tackle fraud, misuse, and overspending

Control cards with spending, geographic, merchant, and industry restrictions. Issue limited-use or single-use cards, and instantly freeze cards as needed. Control which payments are approved based on your business logic, with built-in authentication screening every transaction.

Get up and running fast

Roll out your new virtual card program in as little as two weeks. Launch, test, and iterate your setup with the support of our travel payments specialists. And get all the resources to help you bring your partners on board.

Boost your revenue

Every transaction counts. As your issuer, we build the optimal payment flows to boost your acceptance rates without compromising security. Combined with the preferential interchange revenue you’ll earn from payouts, your bottom line stands to benefit.

Defend against FX risk

Stop paying more than your quoted prices due to unfavorable FX rate changes. With Checkout Issuing, you can spin up a virtual card in a local currency, removing the risk of unfavorable conversion rates when the payment is made to your international suppliers.

Tackle fraud, misuse, and overspending

Control cards with spending, geographic, merchant, and industry restrictions. Issue limited-use or single-use cards, and instantly freeze cards as needed. Control which payments are approved based on your business logic, with built-in authentication screening every transaction.

Get up and running fast

Roll out your new virtual card program in as little as two weeks. Launch, test, and iterate your setup with the support of our travel payments specialists. And get all the resources to help you bring your partners on board.