Connect

Move

Boost

Protect

Use Cases

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Ecommerce

Retail, fashion, consumer goods, and digital services

Crypto

Exchanges and wallet

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.

Optimized payments. Advanced security.

Effortlessly integrate network tokens for better acceptance rates, better payment data security, and lower scheme fees.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Tokenizing payments globally

Here is how Checkout.com is committed to helping global merchants increase their acceptance rates through the adoption of network tokens. *To achieve optimal acceptance rates, it is recommended to use Intelligent Acceptance. Merchants managing their network tokens can achieve these rates by implementing their own optimization strategy.

400+

saved per dispute through resolution automation

200m+

in additional revenue generated for our merchants to date

11%

optimizations performed daily to power leaps in transaction success

Vinted x Checkout.com

”Checkout.com offered us robust cross-border capabilities and helped to accelerate the pace of our expansion. It integrates with our existing customer experience and unlocks transfers to billions of cards worldwide through a single API. It's a game-changer.“

Aleksandr Povarov

Product Manager at Wise

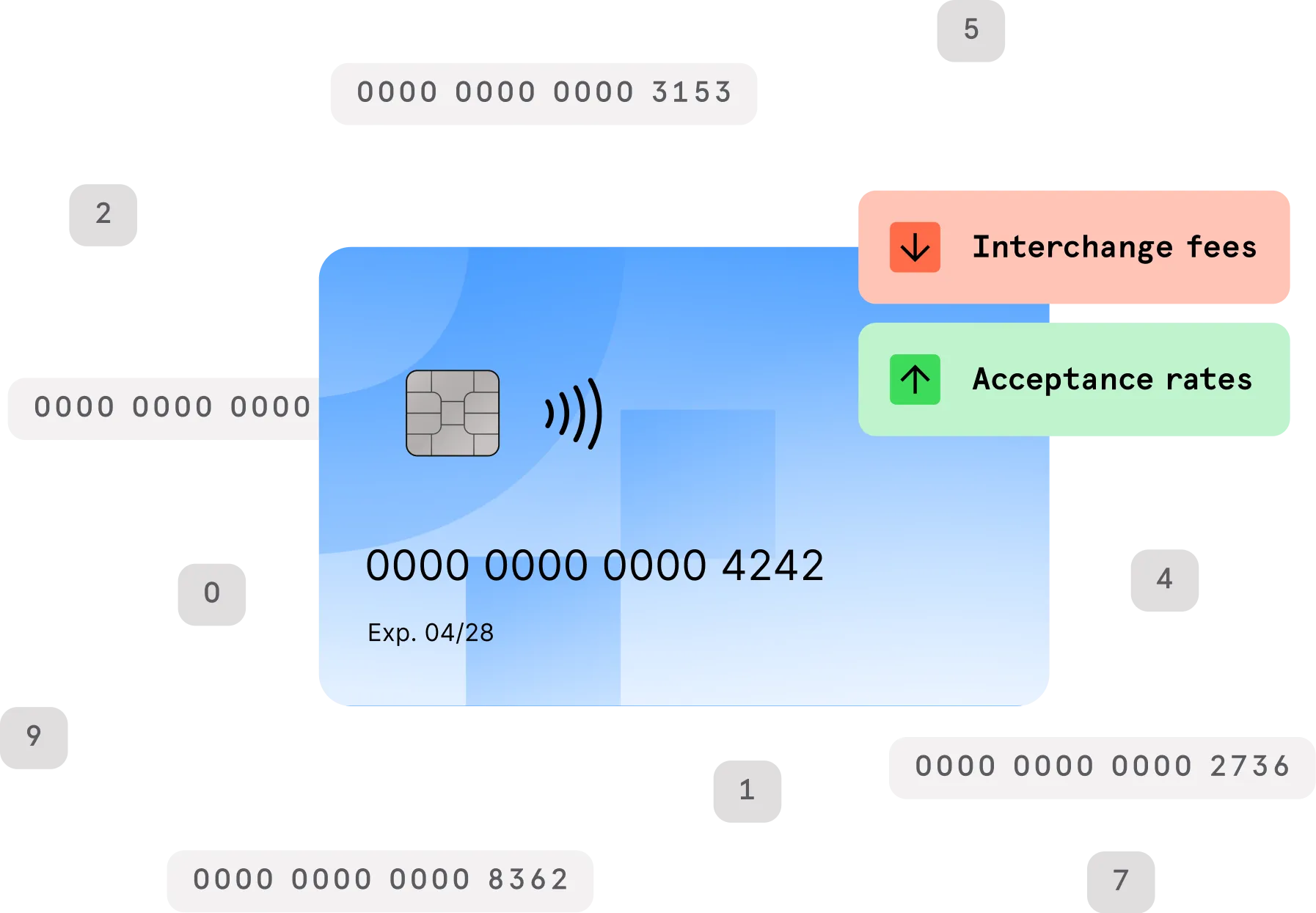

Supercharge payment security and acceptance rates

Network tokens generated by card schemes replace the cardholder's PAN throughout the payment flow. Payment tokenization supports online transaction security, even in the event of a data breach.

Flexible token management

Choose a network token management solution that fits your payment strategy, requires minimal effort to integrate and readily adaptable for network changes.

Managed by us

We manage the entire lifecycle as your network token service provider and PSP, whilst you focus on your core business. Checkout.com provides:

- Asynchronous & synchronous provisioning

- Secure vaulting

- Token updates

- Optimizations

Managed by you

We will soon be offering network tokens compatible across PSPs, making it perfect for an open ecosystem, and you manage:

- Provisioning & updates

- Vaulting options

- Optimization management

- PSP routing

“Since going live with network tokenization with Checkout.com, the Financial Times has seen an overall increase of 1.5% on tokenized transactions. This has not only enhanced their success rate but has led to an enhanced user journey removing pain points such as out-of-date credentials”

Bernard Kpoor

Head of Payment Optimization, The Financial Times

Unlock your payments potential today

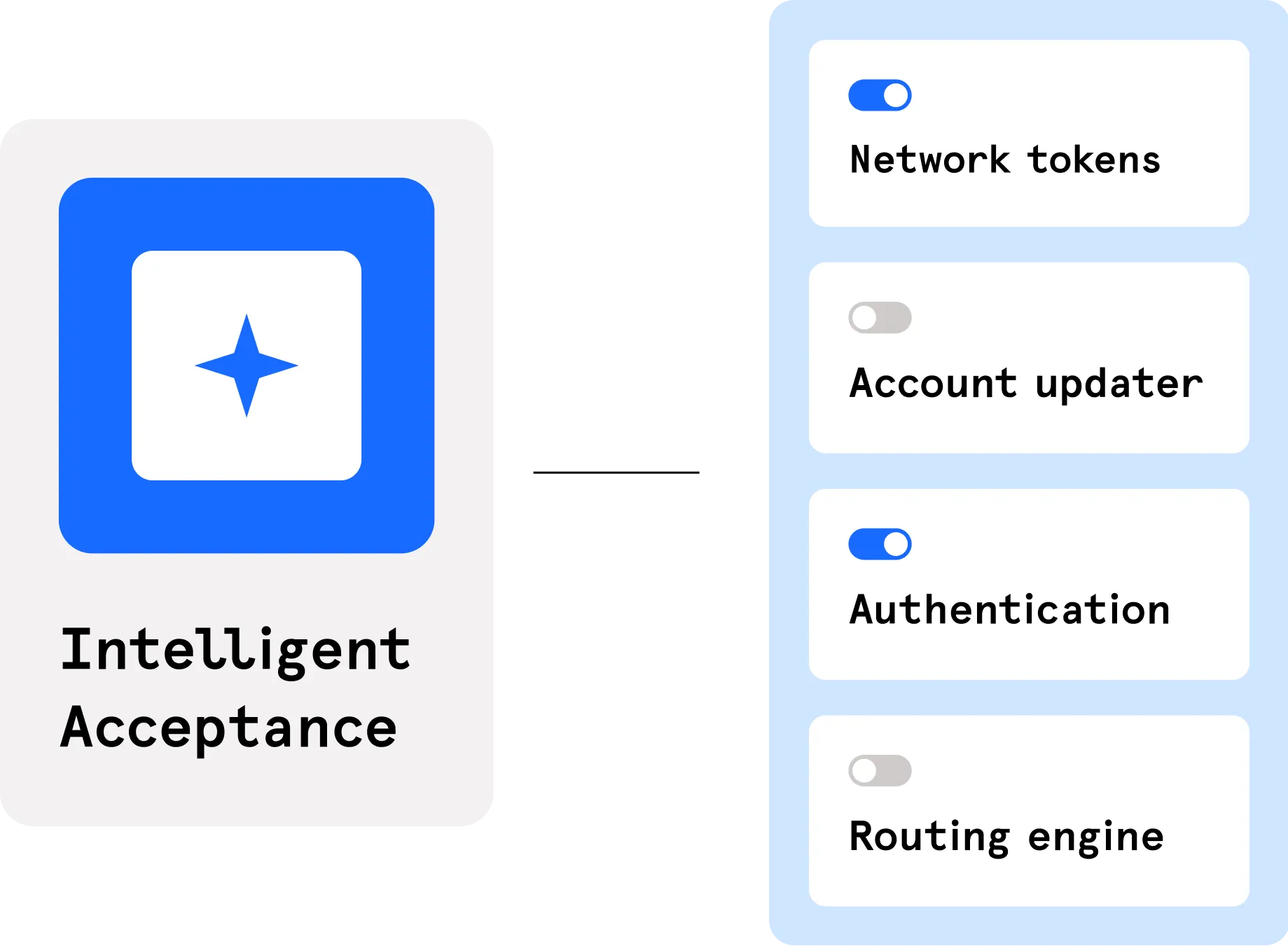

Lift performance automatically

Intelligent Acceptance is an additional performance layer, that unlocks more revenue and cost savings for your business. Leveraging AI and harnessing the power of global network data, Intelligent Acceptance optimizes Network Tokens to their fullest potential, increasing authorization rates and reducing declined transactions.

Frequently Asked Questions

Explore our resources

Explore our resources

Building a modular payments infrastructure

Building a modular payments infrastructure