Connect

Move

Boost

Protect

Use Cases

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Ecommerce

Retail, fashion, consumer goods, and digital services

Crypto

Exchanges and wallet

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.

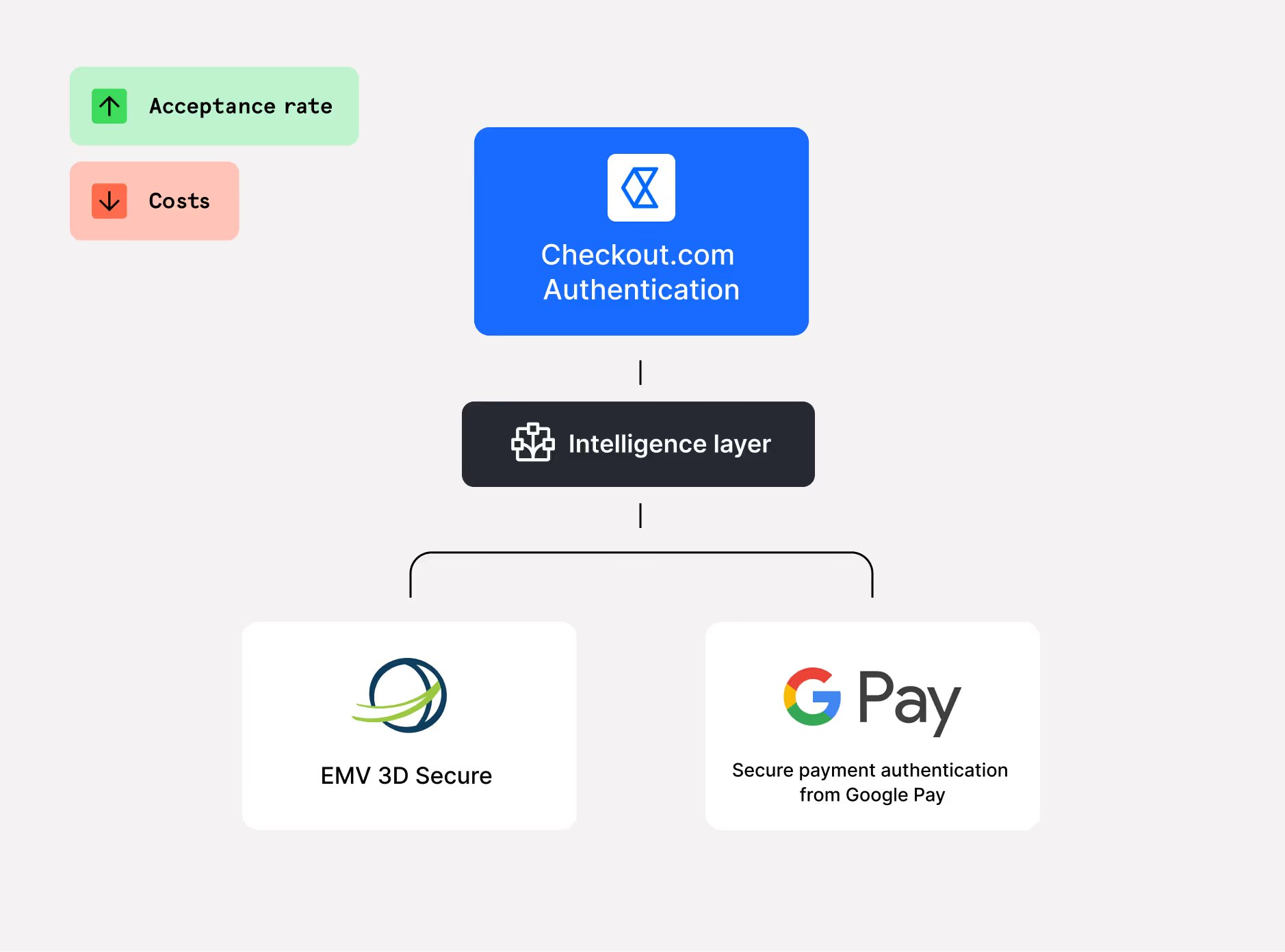

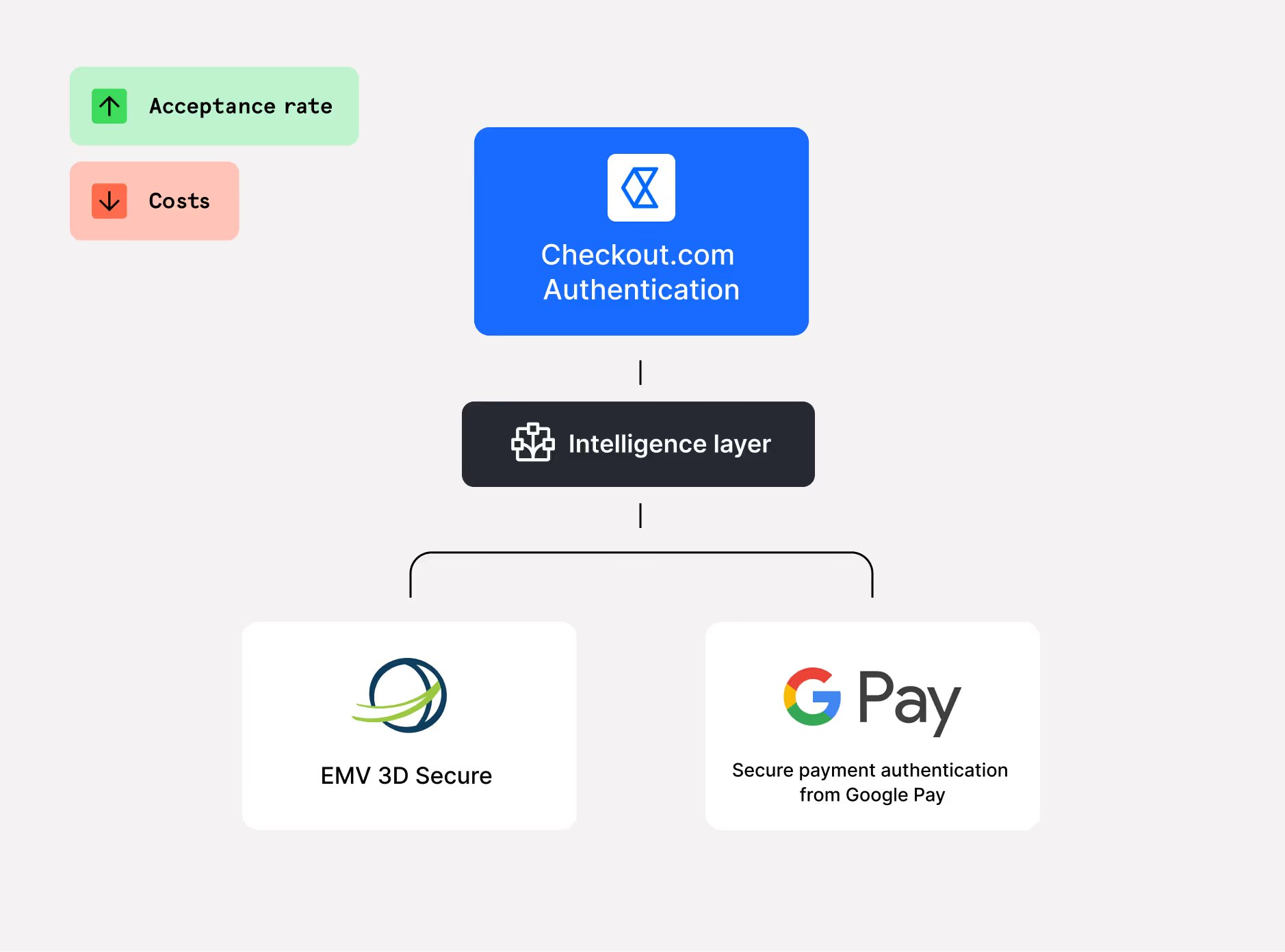

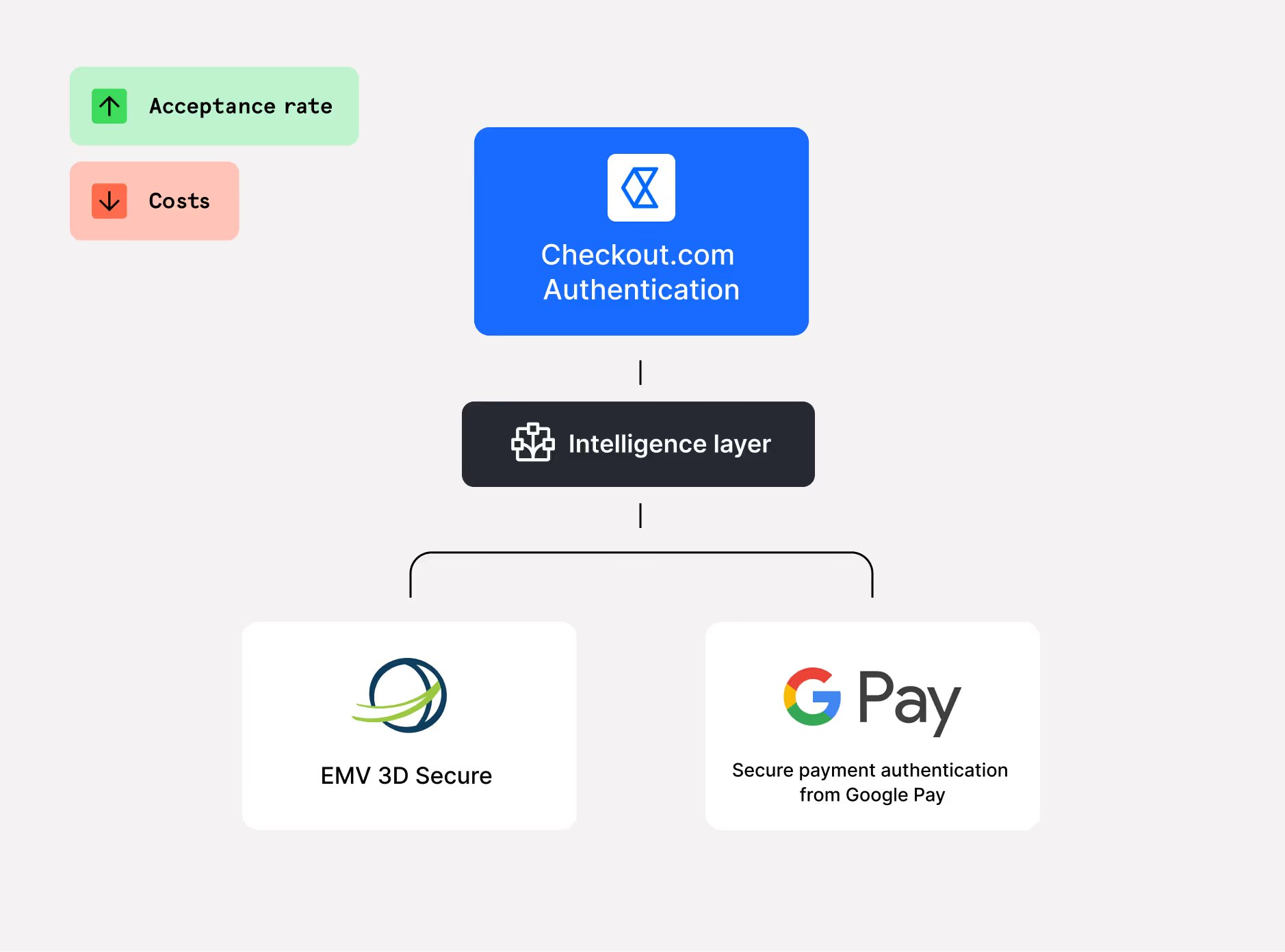

A multi- experience approach to authentication

Improve Performance, Fight fraud and stay compliant. Our authentication solution reduces customer friction by smartly routing payments through 3DS or Google’s authentication technology to ensure the best acceptance rates.

Intelligently increases revenue

Launch your new card program faster and optimize performance with modern card issuing, processing, card management, compliance and reporting capabilities in one place.

Smarter customer experiences

Create unique card experiences that you can quickly scale and modify with a wide array of customization options, including card designs, digital wallets, and spend controls.

Plug & play or fully custom

Automate transaction outcomes using accept or reject logic based on your unique business rules. Then, fund cards upon authorization for immediate use and without pre-funding complexity.

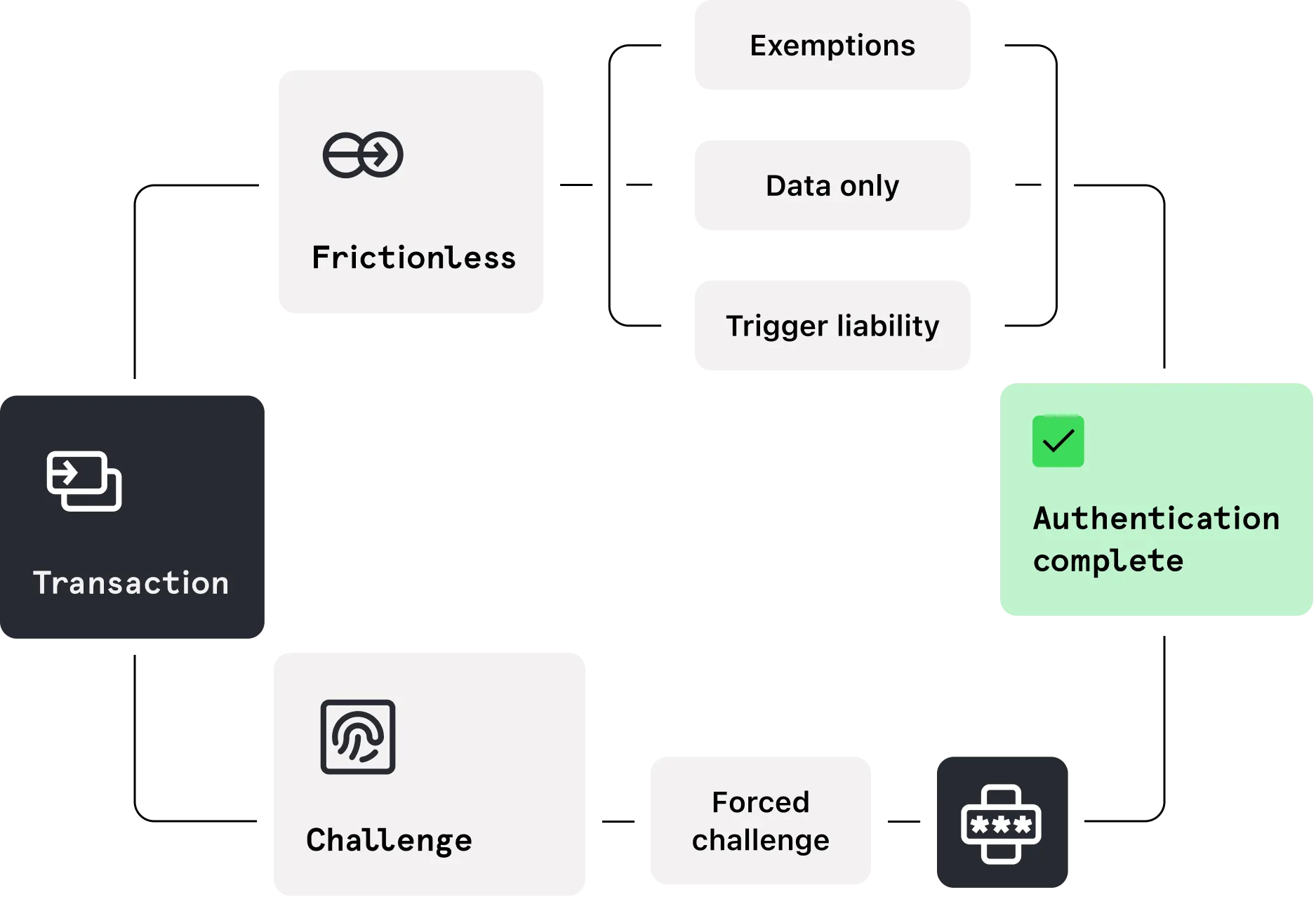

One-stop authentication

By issuing cards, you earn a share of interchange revenue on every transaction. Capture and maximize impact with transparent pricing, granular reconciliation and data-rich transaction reporting.

Intelligently increases revenue

Launch your new card program faster and optimize performance with modern card issuing, processing, card management, compliance and reporting capabilities in one place.

Smarter customer experiences

Create unique card experiences that you can quickly scale and modify with a wide array of customization options, including card designs, digital wallets, and spend controls.

Plug & play or fully custom

Automate transaction outcomes using accept or reject logic based on your unique business rules. Then, fund cards upon authorization for immediate use and without pre-funding complexity.

One-stop authentication

By issuing cards, you earn a share of interchange revenue on every transaction. Capture and maximize impact with transparent pricing, granular reconciliation and data-rich transaction reporting.

Elevate the user experience

-

•

Make your checkout faster

Use device biometrics, like fingerprinting and facial recognition, to authenticate payments for a smoother, speedier checkout flow.

-

•

Simplify security

Customers can breeze through the payment process in as little as three steps, minimizing the risk of cart abandonment.

Elevate the user experience

-

•

Make your checkout faster

Use device biometrics, like fingerprinting and facial recognition, to authenticate payments for a smoother, speedier checkout flow.

-

•

Simplify security

Customers can breeze through the payment process in as little as three steps, minimizing the risk of cart abandonment.

Elevate the user experience

-

•

Make your checkout faster

Use device biometrics, like fingerprinting and facial recognition, to authenticate payments for a smoother, speedier checkout flow.

-

•

Simplify security

Customers can breeze through the payment process in as little as three steps, minimizing the risk of cart abandonment.

-

•

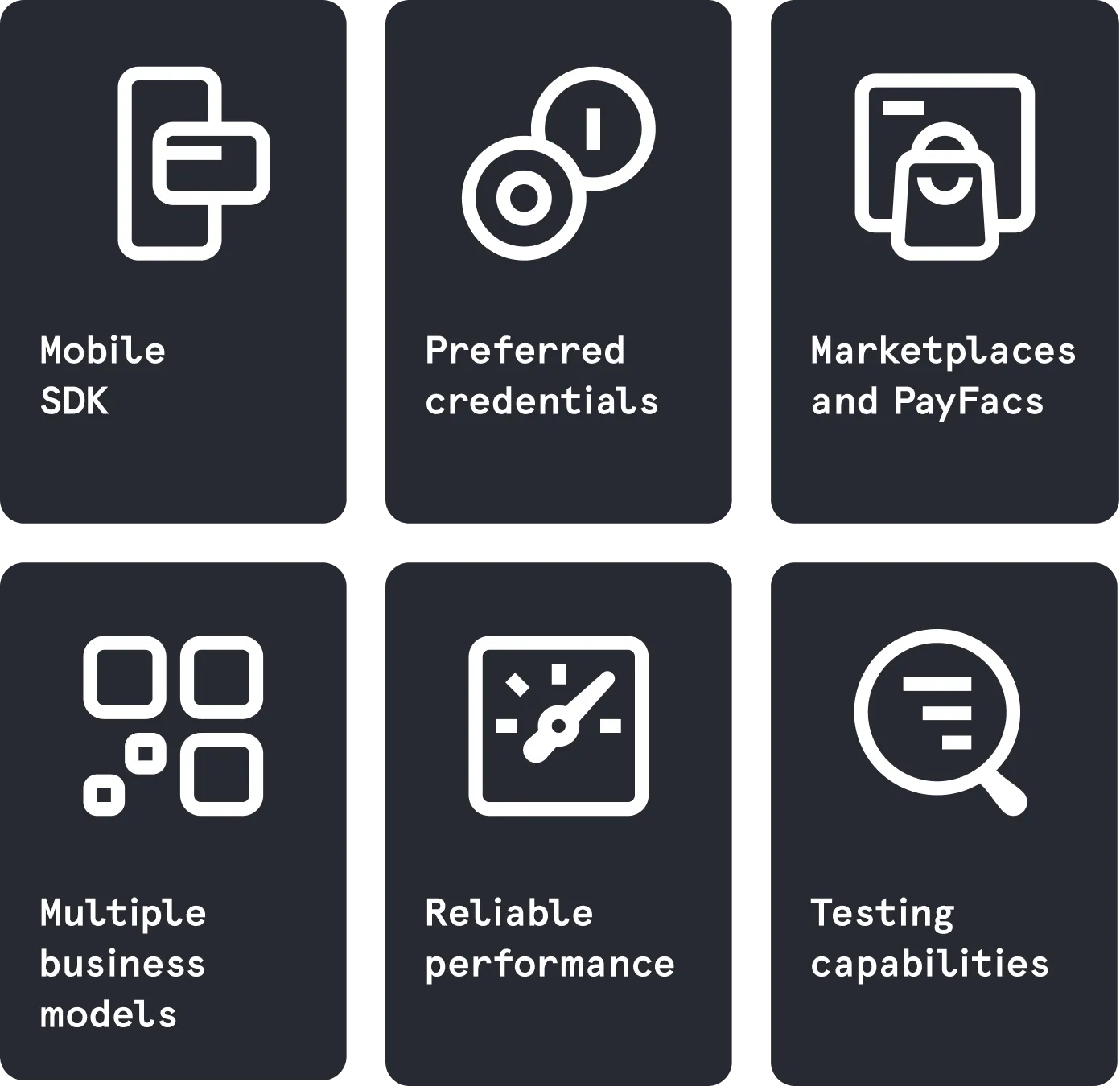

Find your form with smart features

Find the right integration

Go standalone to centralize all authentication in one place, or use as part of our advanced payment platform. We offer a range of options for all sales channels and business types.

Standalone

Streamline your global authentication strategy with our acquirer-agnostic solution.

- One centralized view

- Consolidated global reporting

- Customizable non-hosted options

- Out-of-the-box hosted options

- API, Android, and iOS SDKs available

Standalone

Streamline your global authentication strategy with our acquirer-agnostic solution.

- One centralized view

- Consolidated global reporting

- Customizable non-hosted options

- Out-of-the-box hosted options

- API, Android, and iOS SDKs available

Frequently Asked Questions

Explore our resources

Explore our resources

Building a modular payments infrastructure

Building a modular payments infrastructure