Connect

Move

Boost

Protect

Use Cases

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Ecommerce

Retail, fashion, consumer goods, and digital services

Crypto

Exchanges and wallet

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.

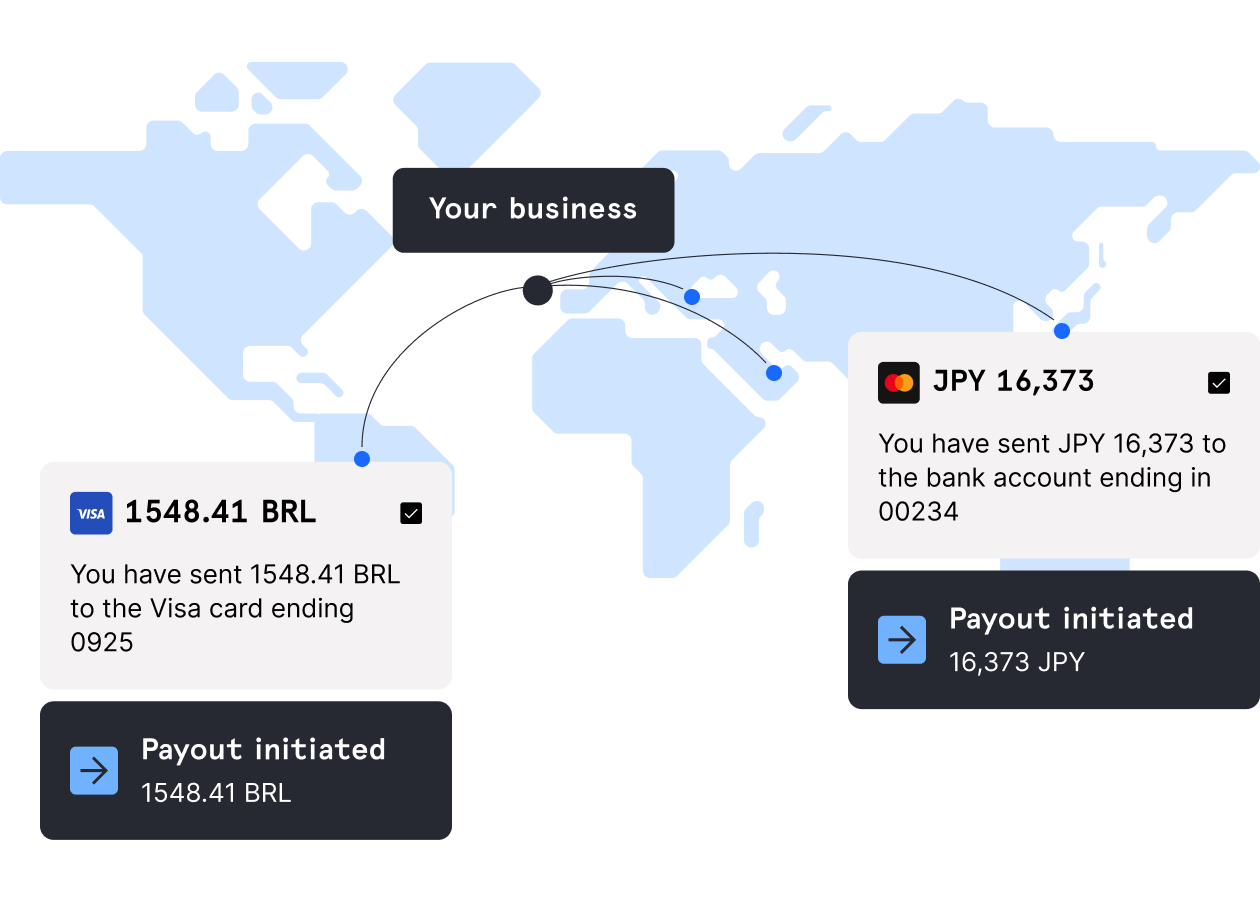

GLOBAL PAYOUT SOLUTIONS

Send seamless payouts with infrastructure built to elevate the customer experience, improve performance and unlock global coverage through a single integration.

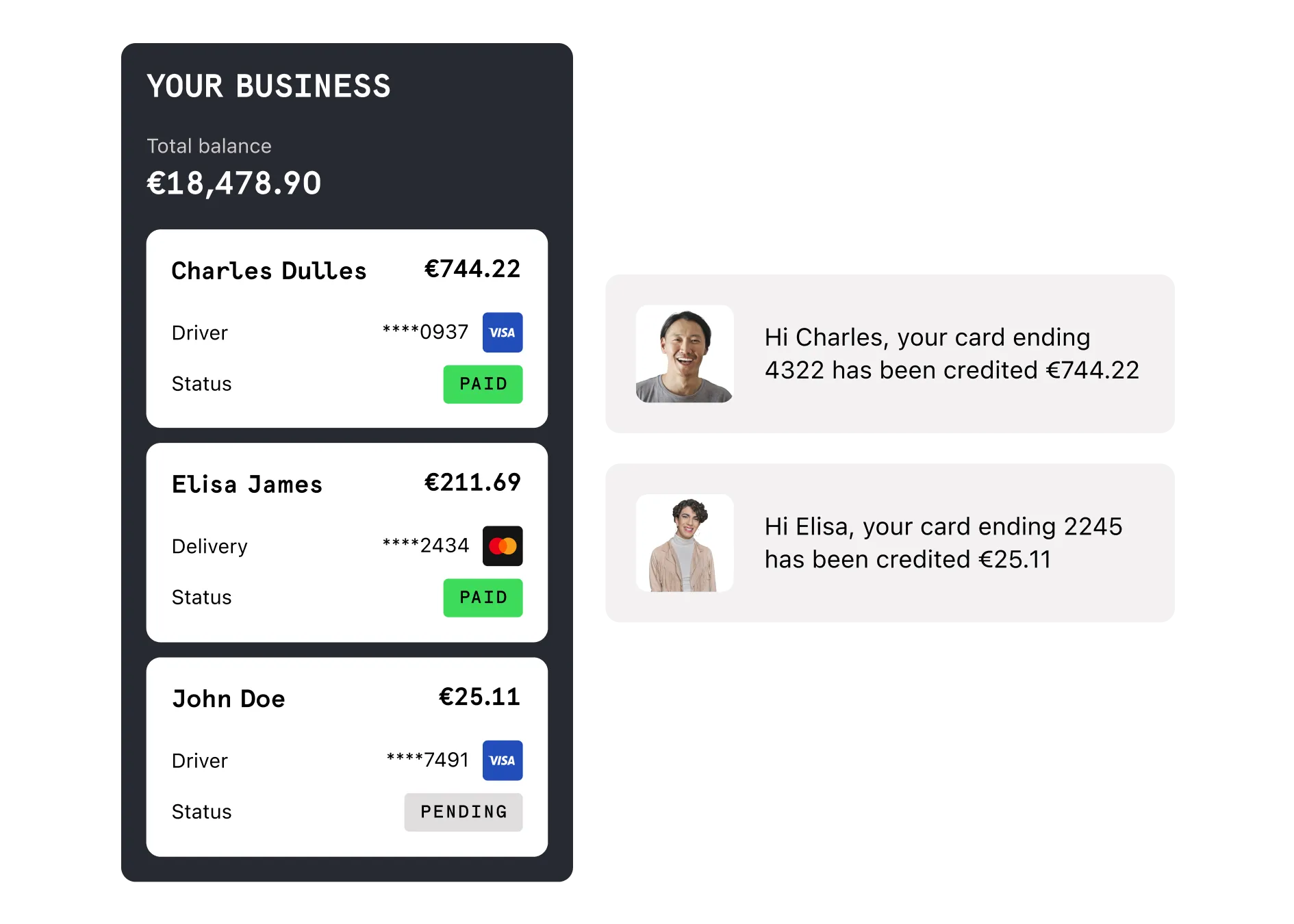

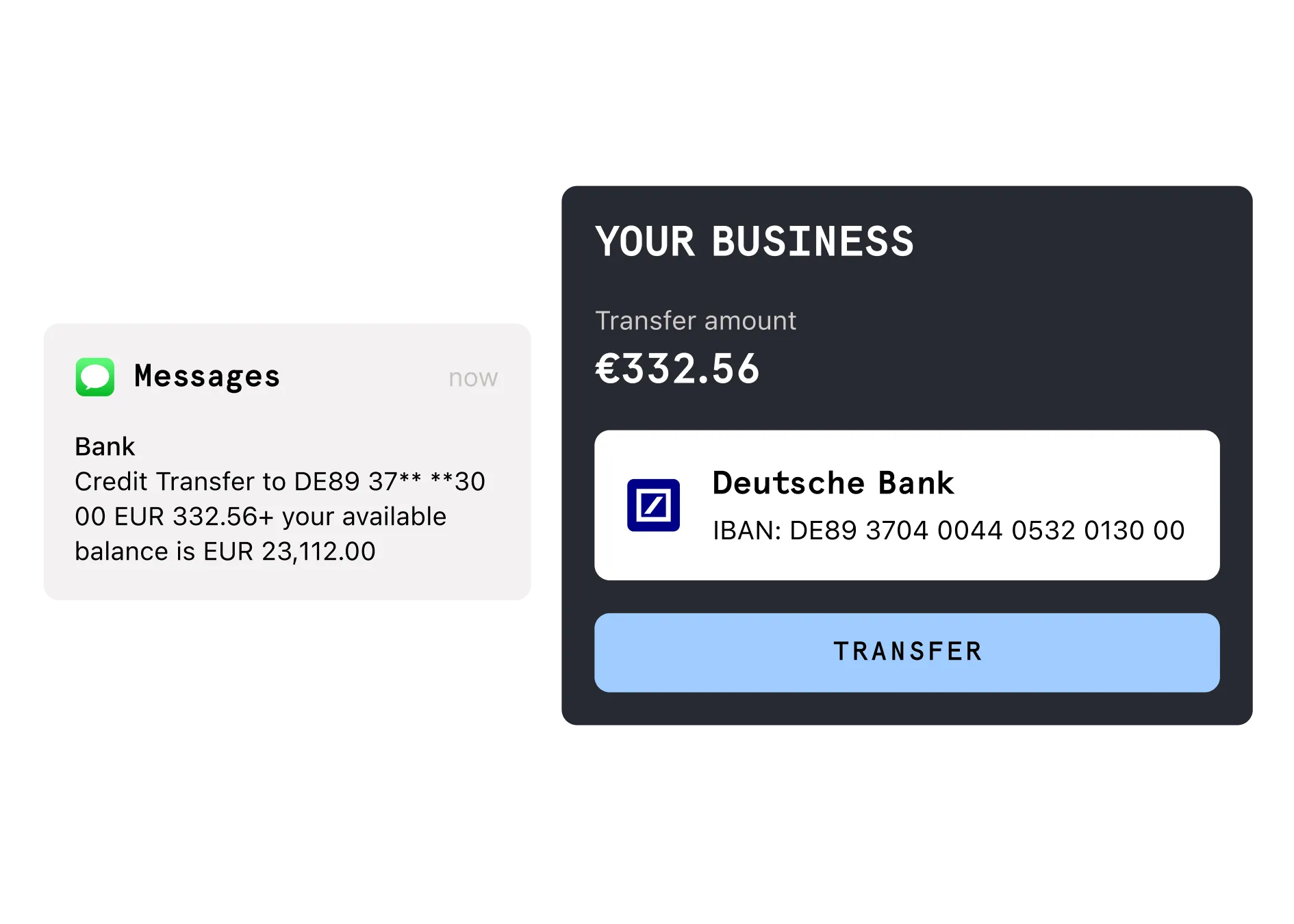

Fast payout methods to transform customer experiences

Turn payouts into a competitive advantage with simple, convenient options that help funds get to customers faster.

Card Payouts

Make payouts to cards with funds available to customers within minutes, not days.

- Web-optimised experience across all browsers

- Responsive design

Card Payouts

Make payouts to cards with funds available to customers within minutes, not days.

- Web-optimised experience across all browsers

- Responsive design

Unlock your payments potential today

Wise x Checkout.com

”Checkout.com offered us robust cross-border capabilities and helped to accelerate the pace of our expansion. It integrates with our existing customer experience and unlocks transfers to billions of cards worldwide through a single API. It's a game-changer.“

Aleksandr Povarov

Product Manager at Wise