Connect

Move

Boost

Protect

Use Cases

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Ecommerce

Retail, fashion, consumer goods, and digital services

Crypto

Exchanges and wallet

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.

MAKE EVERY PAYMENT COUNT

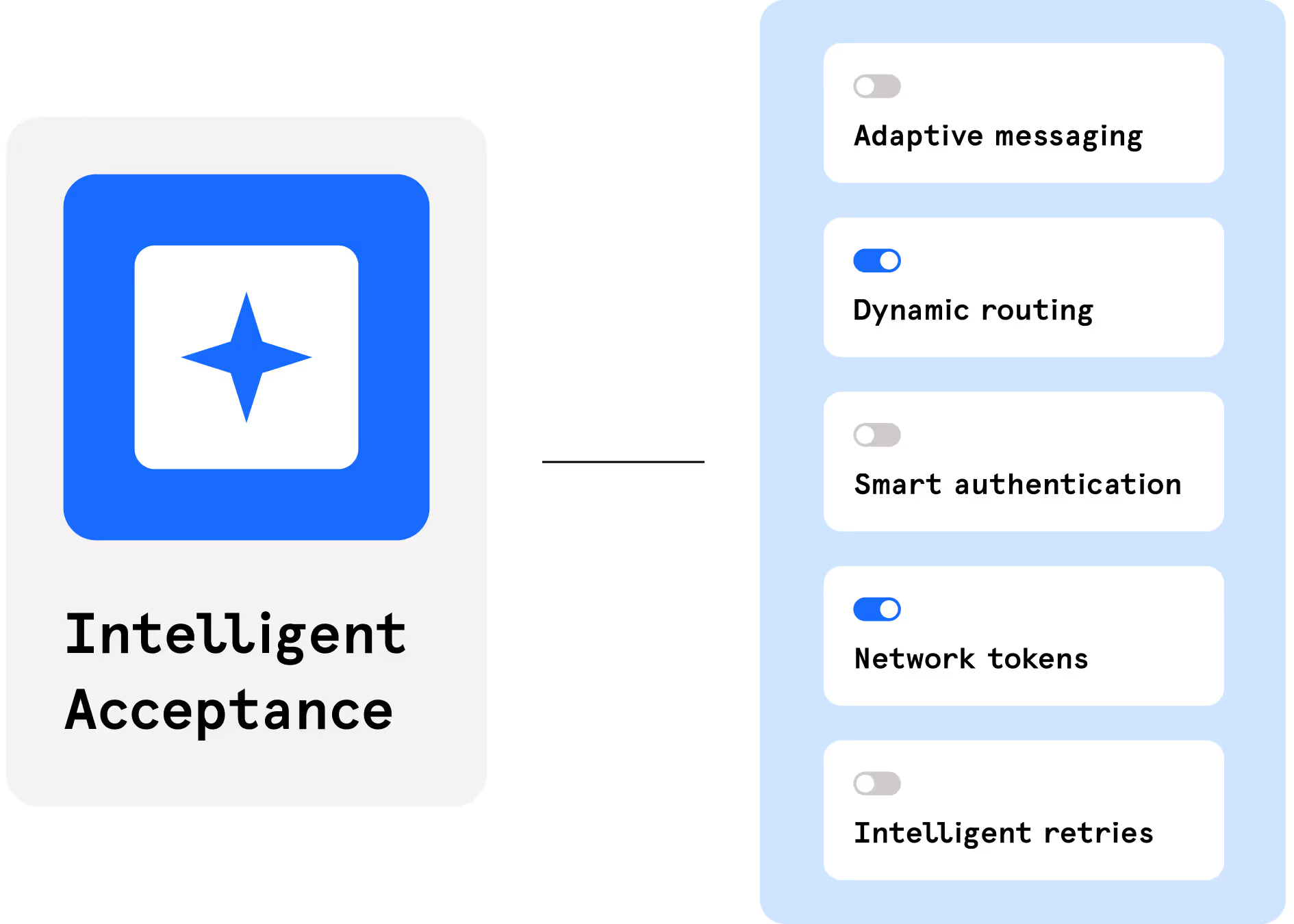

Automatically optimize every payment with Intelligent Acceptance – an AI engine designed to increase conversions and revenue.

Intelligently increases revenue

Launch your new card program faster and optimize performance with modern card issuing, processing, card management, compliance and reporting capabilities in one place.

Smarter customer experiences

Create unique card experiences that you can quickly scale and modify with a wide array of customization options, including card designs, digital wallets, and spend controls.

Plug & play or fully custom

Automate transaction outcomes using accept or reject logic based on your unique business rules. Then, fund cards upon authorization for immediate use and without pre-funding complexity.

One-stop authentication

By issuing cards, you earn a share of interchange revenue on every transaction. Capture and maximize impact with transparent pricing, granular reconciliation and data-rich transaction reporting.

Intelligently increases revenue

Launch your new card program faster and optimize performance with modern card issuing, processing, card management, compliance and reporting capabilities in one place.

Smarter customer experiences

Create unique card experiences that you can quickly scale and modify with a wide array of customization options, including card designs, digital wallets, and spend controls.

Plug & play or fully custom

Automate transaction outcomes using accept or reject logic based on your unique business rules. Then, fund cards upon authorization for immediate use and without pre-funding complexity.

One-stop authentication

By issuing cards, you earn a share of interchange revenue on every transaction. Capture and maximize impact with transparent pricing, granular reconciliation and data-rich transaction reporting.

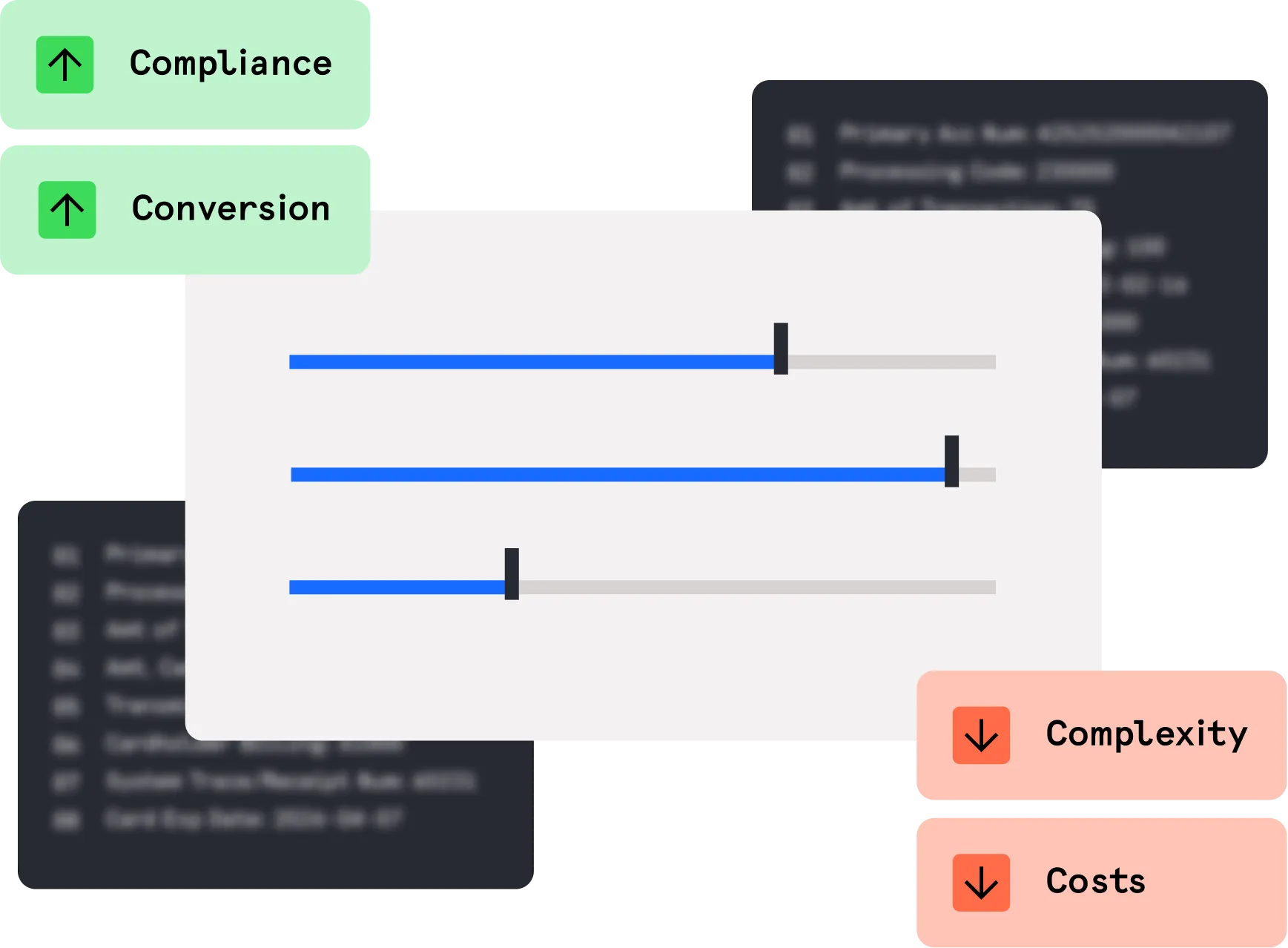

Results that count

Intelligent Acceptance is built to maximize payment performance and bring tangible revenue gains.

3.8%

saved per dispute through resolution automation

$10B+

in additional revenue generated for our merchants to date

60M+

optimizations performed daily to power leaps in transaction success

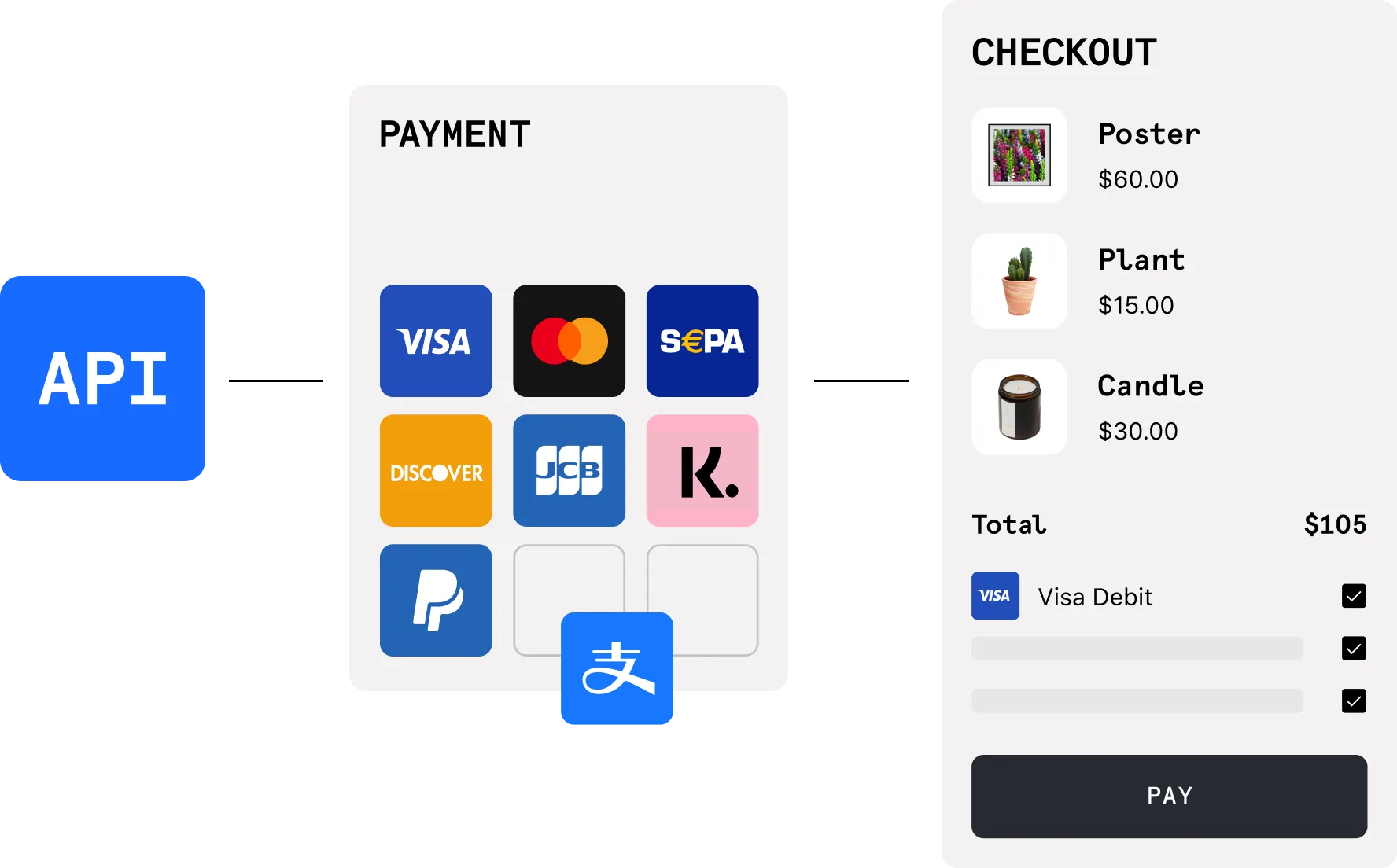

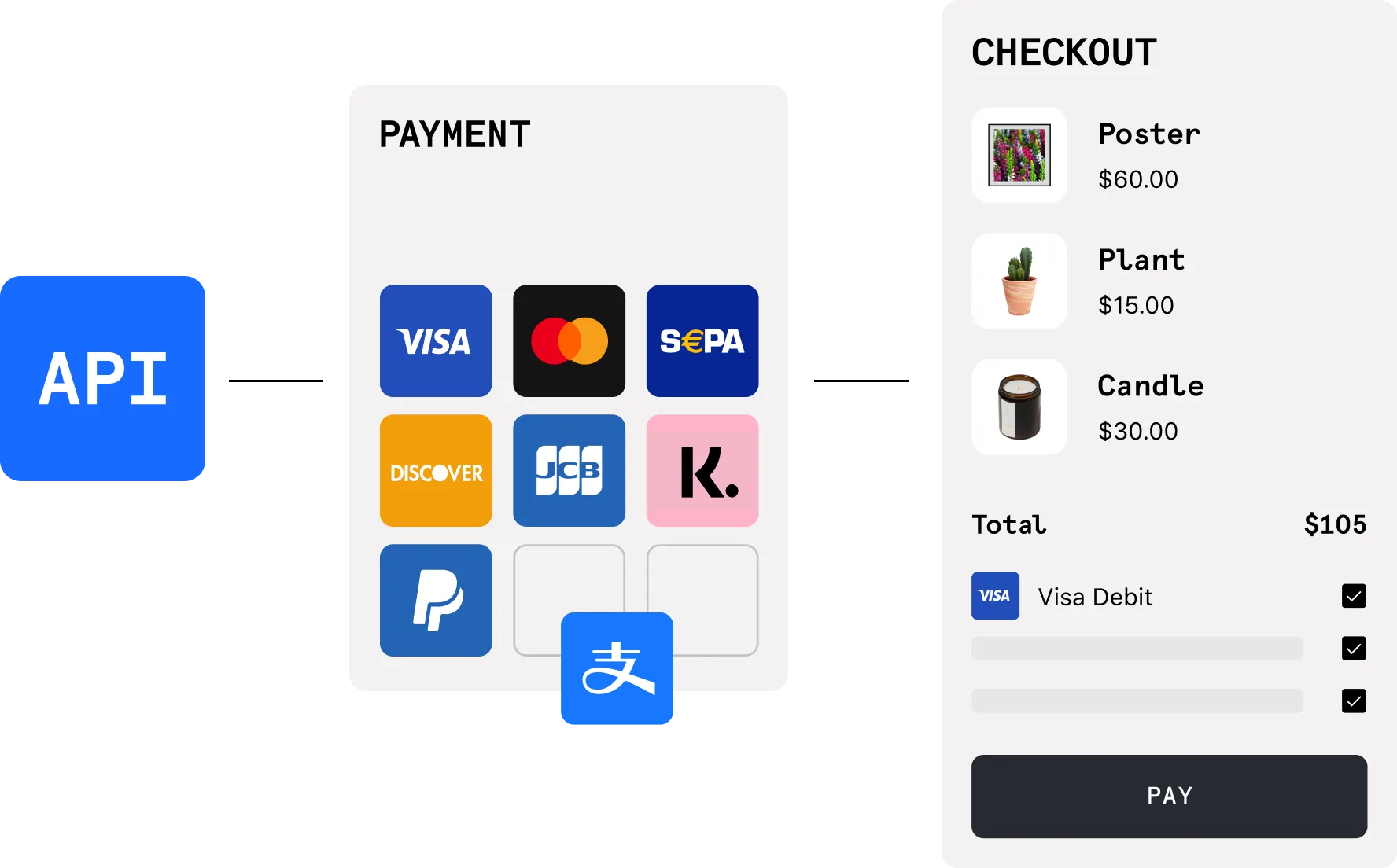

Take control of the payment experience with our flexible API

-

Accept payments, split payments, and make payouts through a single integration, saving engineering resources and reconciliation time by consolidating transactional and financial reporting under one roof.

-

A single API connects all your payments, with robust documentation your engineering teams will love.

-

Fewer technical fail points, secure storage, and resurfacing of payment sources – including cards and bank accounts.

-

Easy navigation, comprehensive documentation, get-started guides, and a sandbox environment to test payments.

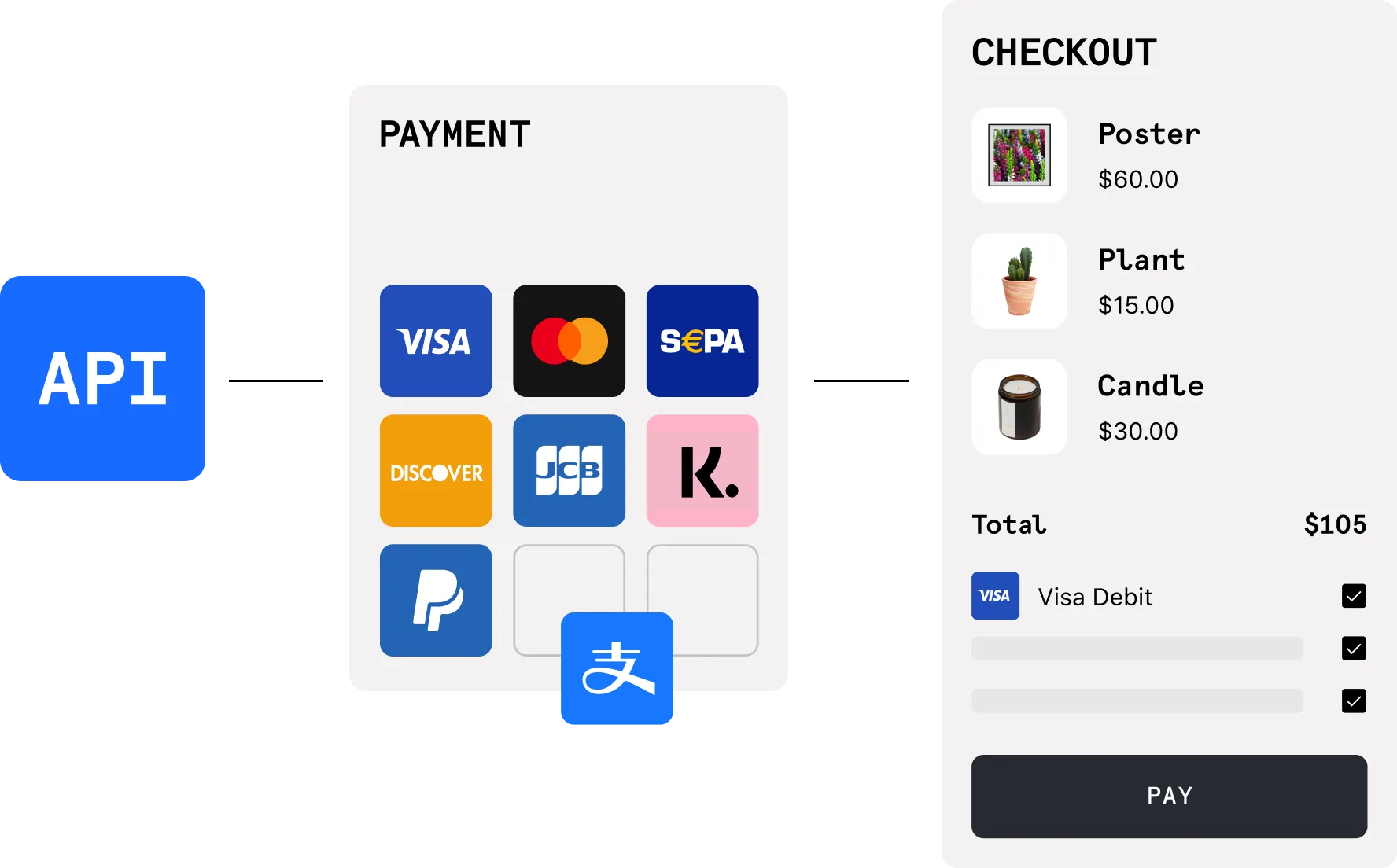

Take control of the payment experience with our flexible API

-

Accept payments, split payments, and make payouts through a single integration, saving engineering resources and reconciliation time by consolidating transactional and financial reporting under one roof.

-

A single API connects all your payments, with robust documentation your engineering teams will love.

-

Fewer technical fail points, secure storage, and resurfacing of payment sources – including cards and bank accounts.

-

Easy navigation, comprehensive documentation, get-started guides, and a sandbox environment to test payments.

Modular optimization fitting your needs

Enjoy full flexibility to optimize payments your way based on your payments stack, market needs, and consumer preferences. Intelligent Acceptance can be applied to certain products or act as a performance layer across your payment flow.

Take control of the payment experience with our flexible API

-

Accept payments, split payments, and make payouts through a single integration, saving engineering resources and reconciliation time by consolidating transactional and financial reporting under one roof.

-

A single API connects all your payments, with robust documentation your engineering teams will love.

-

Fewer technical fail points, secure storage, and resurfacing of payment sources – including cards and bank accounts.

-

Easy navigation, comprehensive documentation, get-started guides, and a sandbox environment to test payments.

Unlock your payments potential today

Wise x Checkout.com

”Checkout.com offered us robust cross-border capabilities and helped to accelerate the pace of our expansion. It integrates with our existing customer experience and unlocks transfers to billions of cards worldwide through a single API. It's a game-changer.“

Aleksandr Povarov

Product Manager at Wise

Explore our resources

Explore our resources

Building a modular payments infrastructure

Building a modular payments infrastructure