Connect

Move

Boost

Protect

Use Cases

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Ecommerce

Retail, fashion, consumer goods, and digital services

Crypto

Exchanges and wallet

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.

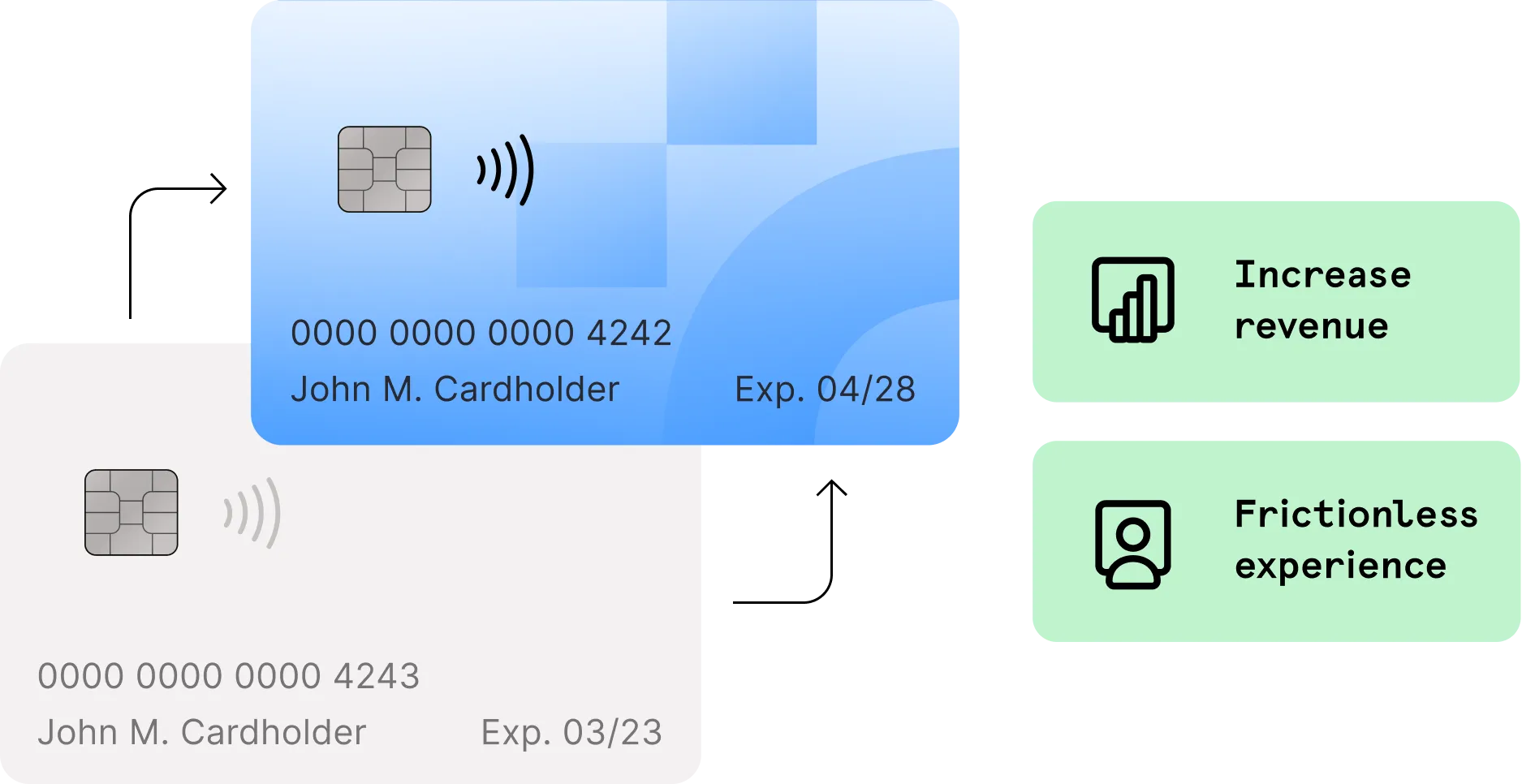

Boost revenue with real-time card updates

Whether your customers’ cards are lost, stolen, or expired, you can prevent missed payments with real-time card updates and keep your customers’ payments flowing.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Drive conversions

Customize your payment flow and remove friction from your payments page with custom prompts and error messages, the ability to pay with saved card details, and more.

Data that matters

Here are some of the ways Real-Time Account Updater optimizes payment efficiency and customer retention. *Visa Account Updater** Mastercard Automatic Billing Updater.

2.5%

Of all card details change yearly, and 35% of customers forget to update their details*

30%

in additional revenue generated for our merchants to date

30%

Decrease in lost customers with automatic account updater**

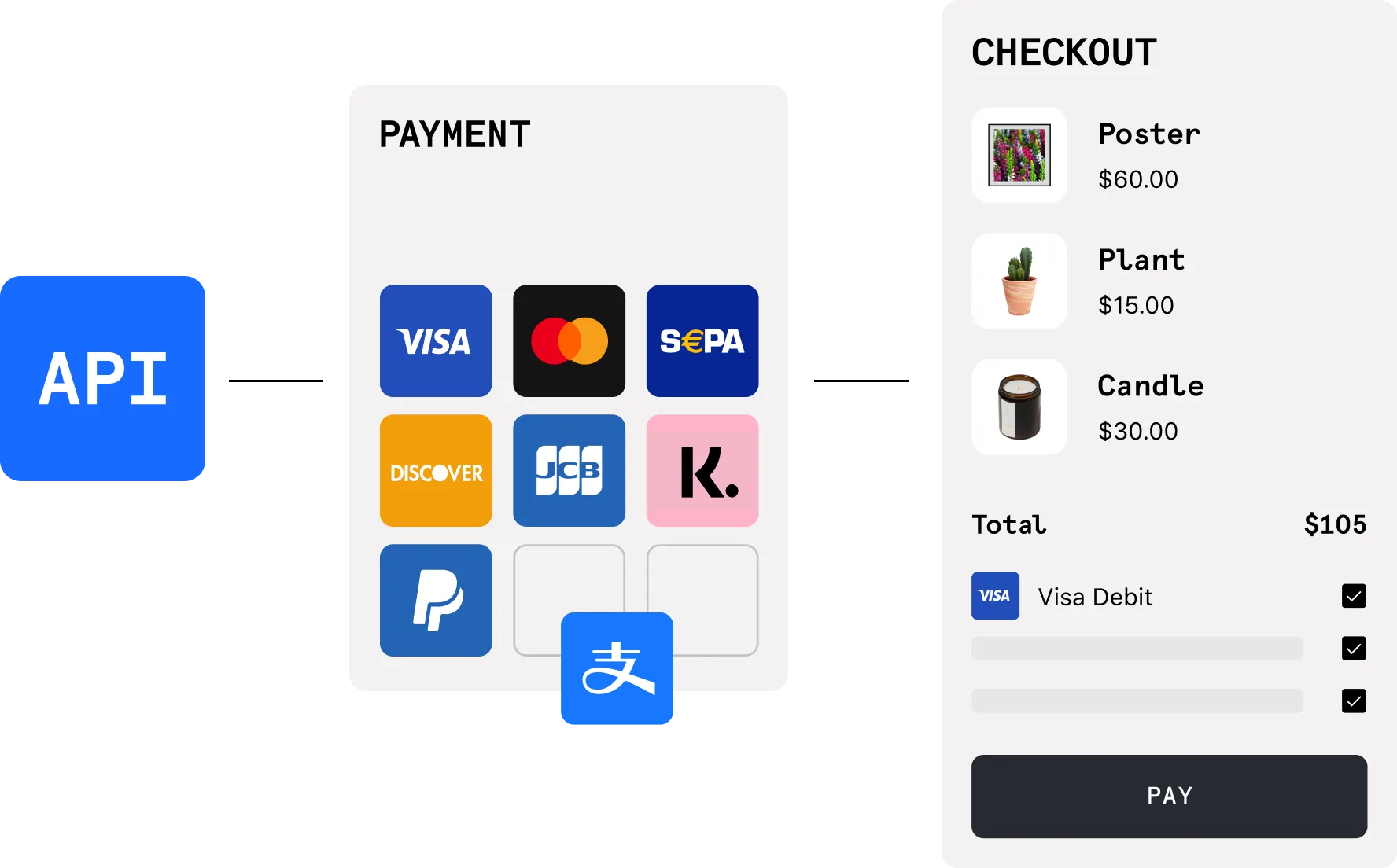

Take control of the payment experience with our flexible API

-

Accept payments, split payments, and make payouts through a single integration, saving engineering resources and reconciliation time by consolidating transactional and financial reporting under one roof.

-

A single API connects all your payments, with robust documentation your engineering teams will love.

-

Fewer technical fail points, secure storage, and resurfacing of payment sources – including cards and bank accounts.

-

Easy navigation, comprehensive documentation, get-started guides, and a sandbox environment to test payments.

“At NordVPN, we recognize the importance of a smooth online payment experience for our users. Enabling Real-Time Account Updater ensures that transactions remain successful, and subscriptions are uninterrupted when our customers' payment card details change.”

Kestas Sauli

Head of Payments, Nord Security

Unlock your payments potential today

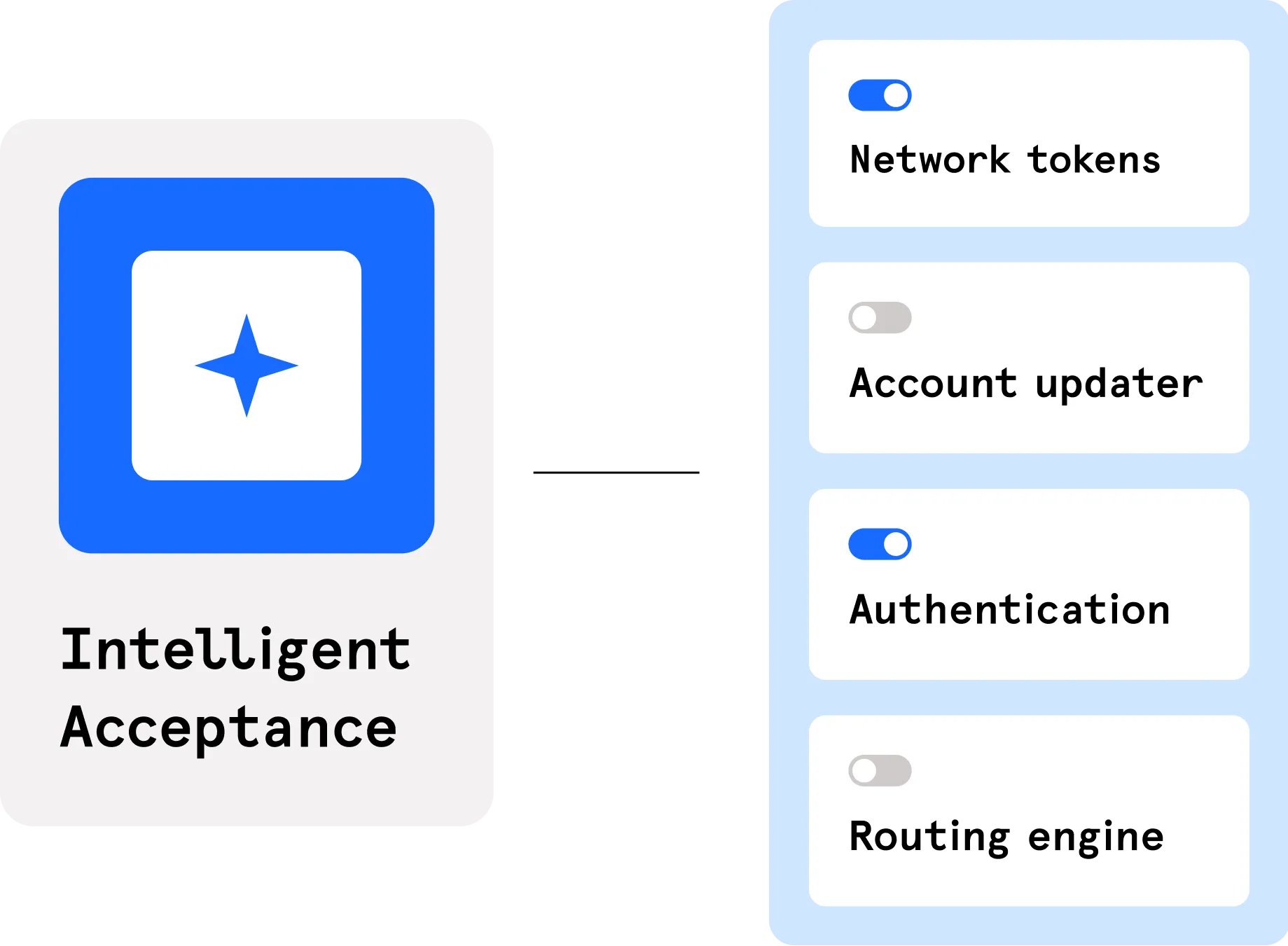

Further enhance your acceptance rate

Continue to boost payment performance with Intelligent Acceptance. Whether you apply it to specific products or use it as a performance layer across all your Checkout.com products, it can increase conversion and unlock untapped revenue.

Frequently Asked Questions

Explore our resources

Explore our resources

Building a modular payments infrastructure

Building a modular payments infrastructure