Connect

Global payments network

Move

Payins and payouts

Protect

Fraud, risk, & compliance

Boost

Payment performance

Manage

Money movement controls

Accept Online

Process online payments your way.

Unified Payments API

Connect via a single API.

Flow

Customizable payment components.

Hosted Payment Page

Secure checkout experience.

Mobile SDK

Native mobile experiences.

Payment Links

Accept payments anywhere.

Plugins

Plug your payments into platforms

Acquiring

Accept payment globally with local acquiring

Payment Methods

Process payments with cards, wallets, transfers, and vouchers

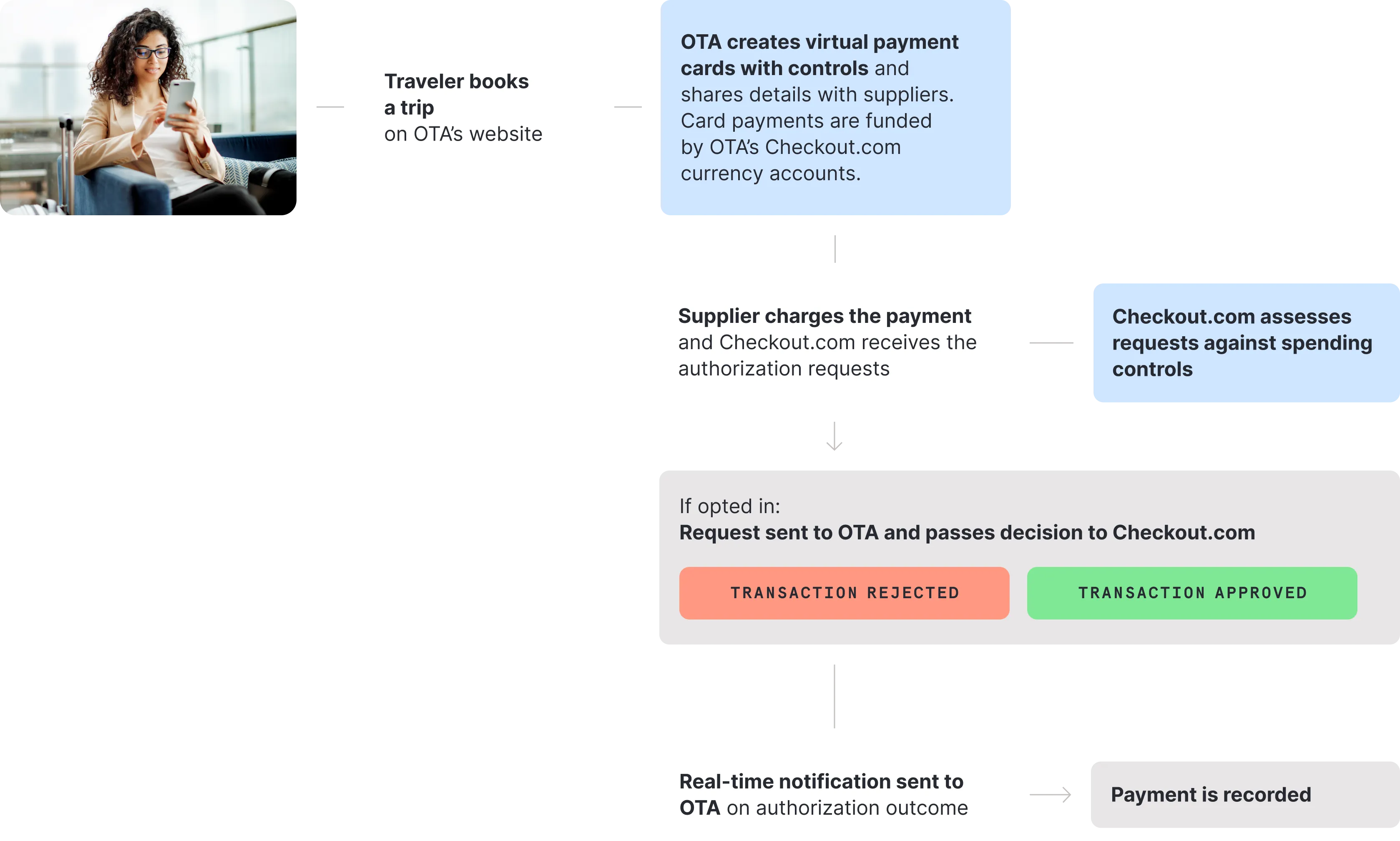

Issuing

Process payments with cards, wallets, transfers, and vouchers

Payouts

Process payments with cards, wallets, transfers, and vouchers

Fraud Detection

AI-powered fraud prevention.

Authentication

Simplify authentication and compliance.

Disputes

Protect against chargebacks and manage disputes

Vault

Protect, store, enrich, exchange, your payment data.

Use Cases

Global payments network

Our EcoSystem

Payins and payouts

Ecommerce

Retail, fashion, consumer goods, and digital services

Fintech

Neobanks, money transfer, trading and insurance

Gaming

Sports, e-sports, game streaming and virtual reality

Crypto

Exchanges and wallets

Marketplaces

Multi-sided markets and platforms

Payment Facilitator

Fintech and financial service providers

Travel

Online bookings platforms, agents and supplier partner.